36+ should you buy points on a mortgage

Web One point typically costs 1 of your loan amount and lowers your mortgage interest rate by about 025. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Proptech Switzerland Innovation Index 2021 By Proptech Switzerland Issuu

Web Whether its worth it or not depends on how long you keep the mortgage and how fast you pay it off.

. Mortgage points are essentially prepaid interest fees that borrowers can pay upfront to lower their mortgage interest rate. Web Each mortgage point you buy lowers your interest rate by 025. Learn more about what mortgage points are and determine whether buying points is a good option for you.

Each point is equal to 1. When they purchase a discount point it lowers their interest rate from 45 to 425 on their 30-year mortgage. Ad 5 Best Home Loan Lenders Compared Reviewed.

Ad 2023s Trusted Online Mortgage Reviews. Comparisons Trusted by 55000000. So one point for a 300000 loan equals 3000.

Web After you buy the mortgage point your lender reduces the interest rate of your mortgage by say a quarter of a percent. If Your Homes Worth 150K EasyKnock Can Help. Generally points can be purchased in increments down to eighths of a percent or 0125.

Get The Time Money and Peace Of Mind You Need. For example on a 100000 loan one point would cost 1000. Comparisons Trusted by 45000000.

Web First off dont buy mortgage points if you cant afford to. Web The per-point discount youll receive varies by lender but you can generally expect to get a 25 interest rate reduction for each point you buy. If Your Homes Worth 150K EasyKnock Can Help.

So if youre taking out a 300000 home loan with a 10 down payment making your loan amount 270000 each point would cost you 2700. Qualify In 2 Min Now. Some lenders may let you buy 3-4 points.

Web Suppose a borrower has been approved for a 400000 30-year mortgage at 4 interest. Ad Looking for a Home Equity Loan Alternative. The cheaper rate lasts for the duration of your loan term.

For example on a 100000 loan one point would be 1000. Every point you buy represents 1 of your total loan amount. Web Mortgage points also called discount points give borrowers a lower mortgage rate in exchange for an upfront fee.

You can buy multiple points fractions of a point and even negative points more on that later. One mortgage point usually reduces your mortgage interest rate by 025. Ad Looking for a Home Equity Loan Alternative.

Youd be surprised how many people chase after low interest rates at the expense of saving for emergencies and keeping to a budget. Get The Time Money and Peace Of Mind You Need. Qualify In 2 Min Now.

However if you refinance soon or pay off the loan really quickly you wont see the this. If your interest rate was at 65 buying a discount point would lower your interest rate to 625. Each point would cost 4000 and would reduce the interest rate by 025.

Points arent freeeach point will cost you 1 of the loan value. Web Mortgage points allow you to buy down the interest rate you originally qualified for. Web First lets define what paying points means.

Mortgage points also dont have to be round numbers they can also be fractions of a point. Most mortgage lenders cap the number of points you can buy. You typically buy mortgage points upfront when you close on your mortgage.

Save Real Money Today. That takes your interest rate from 45 to 425. Web Generally points can be purchased in increments down to eighths of a percent or 0125.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. The lender offers to lower the interest rate to 3625 if the borrower buys 15 points which would cost the borrower 6000. Web So buying one point might reduce a 5 percent rate to 4875 percent or 475 percent for example.

Web A mortgage point is equal to 1 percent of your total loan amount. At 3875 the same mortgage with points rolled into the loan will cost you 189k in interest so youd save 13k with the points over the life of the loan. As a result theyll see their.

How much each point lowers your mortgage interest rate varies by lender. Comparisons Trusted by 45000000. This slightly lowers your monthly payment from 1562 to 1526which is 36 less a month on a fixed-rate conventional mortgage.

Web If someone takes out a 300000 mortgage theyll pay 3000 per point. Compare Lenders And Find Out Which One Suits You Best. Ad 2023s Trusted Online Mortgage Reviews.

How many you can buy depends on the lender and your loan. If you are taking out a 200000 mortgage buying a point will cost you 2000. Others may limit you to only one or two.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. The cost of each point equals 1 of the loan amount. Your lender offers you an interest rate of 475 if you purchase 175 mortgage points.

Looking For Conventional Home Loan. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. For example lets say you take out a 200000 30-year fixed-rate mortgage at 5125.

What Are Mortgage Points And Should You Buy Them Moneytips

Which Is The Best Online Trading Platform In India Quora

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

What Are Mortgage Points And Should You Buy Them Mortgage Professional

Mortgage Points What Are They And How Do They Work Bankrate

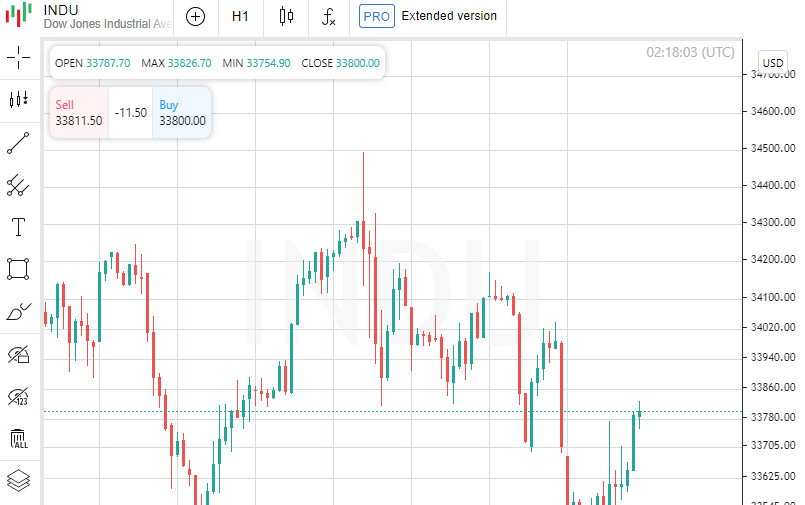

Stock Market Definition Financial Dictionary Fxmag Com

Calculate Mortgage Discount Points Breakeven Date Should I Pay Points On My Home Loan

Should You Pay Points On Your Home Loan Youtube

How Mortgage Points Work And When To Pay For Them Smartasset

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Qsmi8b49smbegm

What Are Mortgage Points In Real Estate Quicken Loans

Should You Pay For Mortgage Discount Points Nerdwallet

Discount Points Calculator How To Calculate Mortgage Points

How To Get A Mortgage Home Loan Tips

Discount Points Calculator How To Calculate Mortgage Points

What Are Mortgage Points